I am a software engineer with over 15 years of experience and have been actively involved in the crypto industry since 2017. This is now my third major cycle in crypto (currently working on DeFi Koala). One pattern I've noticed is that most of my friends buy crypto at the peak of each four-year cycle — often buying at the top — only to experience massive unrealized losses (or realized losses if they sell).

However, those who don't sell typically leave their tokens on centralized exchanges, missing out on passive income opportunities. Even those who sold for a profit often let their stablecoins sit idle, waiting for a price dip to buy back in. I'm sharing this because trading is difficult, but there's a better way to accumulate more crypto without trading.

A Common Mistake: Ignoring Passive Income

From speaking with many crypto holders, I've found that most don't realize they can earn a yield on their assets. In this post, I'll share a simple strategy to generate passive income on your crypto.

A Simple Strategy: Lending Out Your Stablecoins

One of the easiest ways to earn passive income is by lending out your stablecoins (e.g., USDC) to borrowers who pay interest. DeFi lending platforms require overcollateralization, meaning borrowers must deposit collateral that exceeds the loan amount. If their collateral value drops too close to their borrowed amount plus interest, they get liquidated, and lenders are automatically repaid.

One downside? Variable interest rates.

For example, the average annual yield on supplied USDC on Aave was 6.28% APR over the past year. That means a $10,000 deposit would have earned $628 — compared to 0% if left on an exchange.

The problem? The interest rate fluctuates.

A Better Strategy: Locking in a Fixed Yield

That's where Pendle comes in. Pendle lets you lock in a fixed yield for a set period, removing uncertainty.

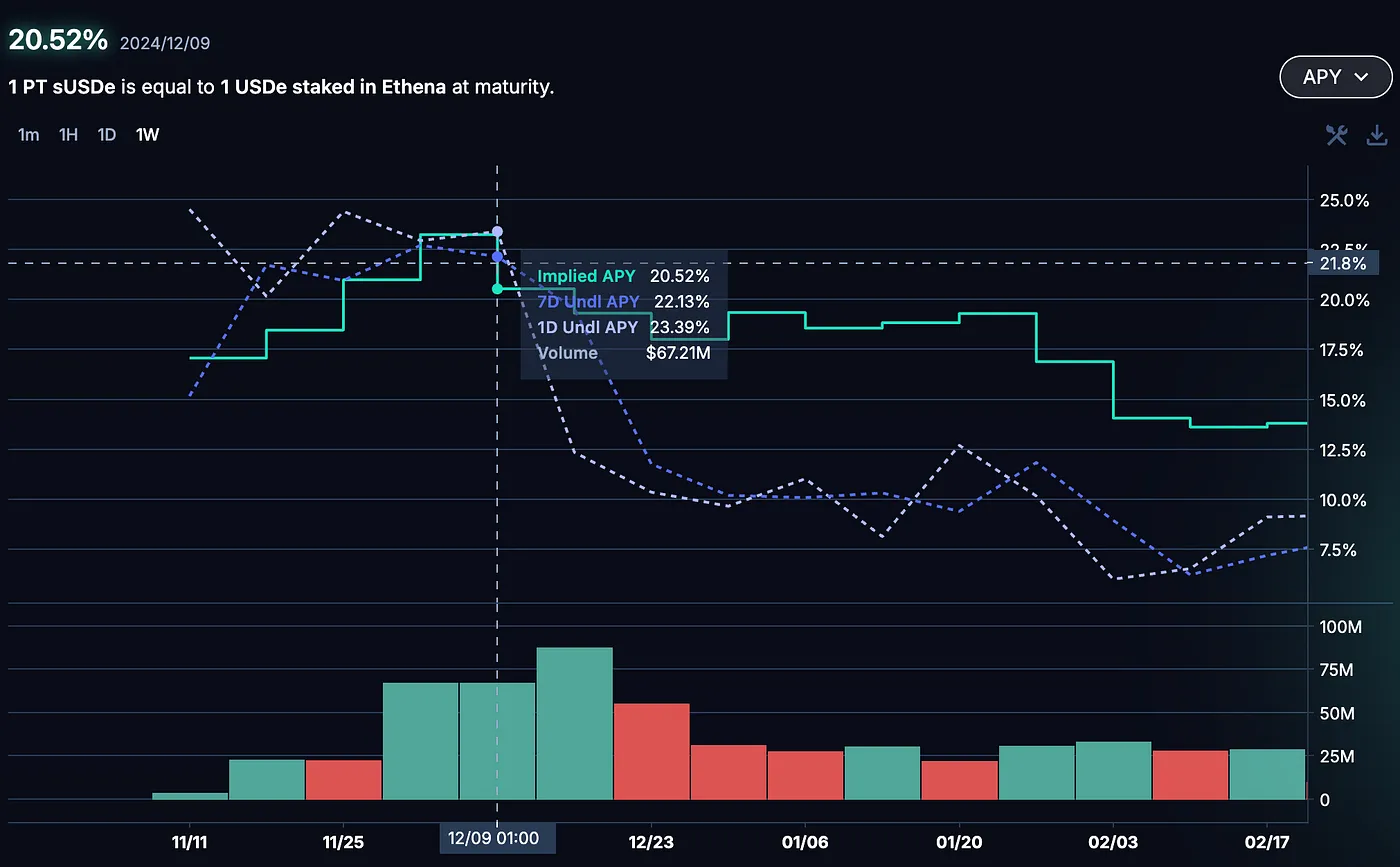

For example, in December 2024, the variable APR on Ethena reached 27%. While that sounds great, it wasn't stable — by the time of writing, it dropped to 9%.

To solve this, I used Pendle to lock in a 20.5% fixed yield (annualized) for six months.

How does Pendle work?

Pendle splits yield-bearing tokens into:

- Principal Tokens (PT) — Steadily increase in value over time.

- Yield Tokens (YT) — Provide variable interest but decay as maturity approaches.

In December, I swapped USDC for sUSDe on CowSwap (a DEX aggregator which consistently gave me better rates than Uniswap). Then, I bought the sUSDe PT token with a maturity date of May 29, 2025.

By that date, my 20.5% APY will be realized.

This means that for a $10,000 investment, I will receive $10,951 by May 29, 2025. Also, in case I'd need the funds earlier I can withdraw with partial profit.

Note: Since I only locked for six months, my realized APR is ~9.5%.

If I had locked for a full year, I would have received the full 20.5%.

Upon maturity, I'll likely reinvest with Pendle, but depending on market conditions some other DeFi opportunities will be considered as well.

Pendle essentially tokenizes a zero-coupon bond, making fixed-yield DeFi strategies accessible.

Step-by-Step Guide

Before proceeding, I assume you already:

- ✅ Know what a crypto wallet is.

- ✅ Know how to deposit tokens from a centralized exchange to an external, self-custodial wallet.

Tip: To interact with DeFi, you need a self-custodial wallet (e.g., MetaMask) or a hardware wallet (e.g., Ledger connected to MetaMask).

1. Connect to Pendle

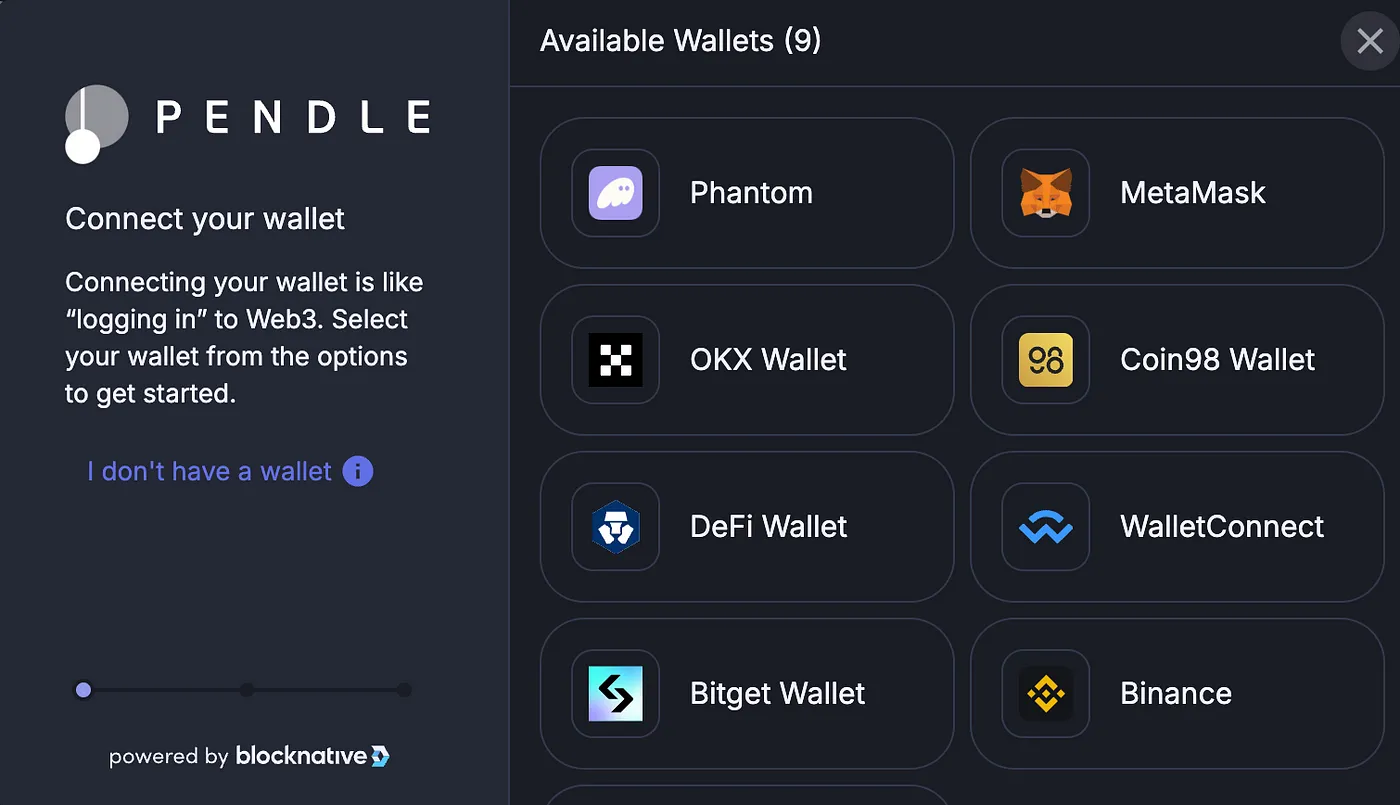

- Go to Pendle and click Connect Wallet.

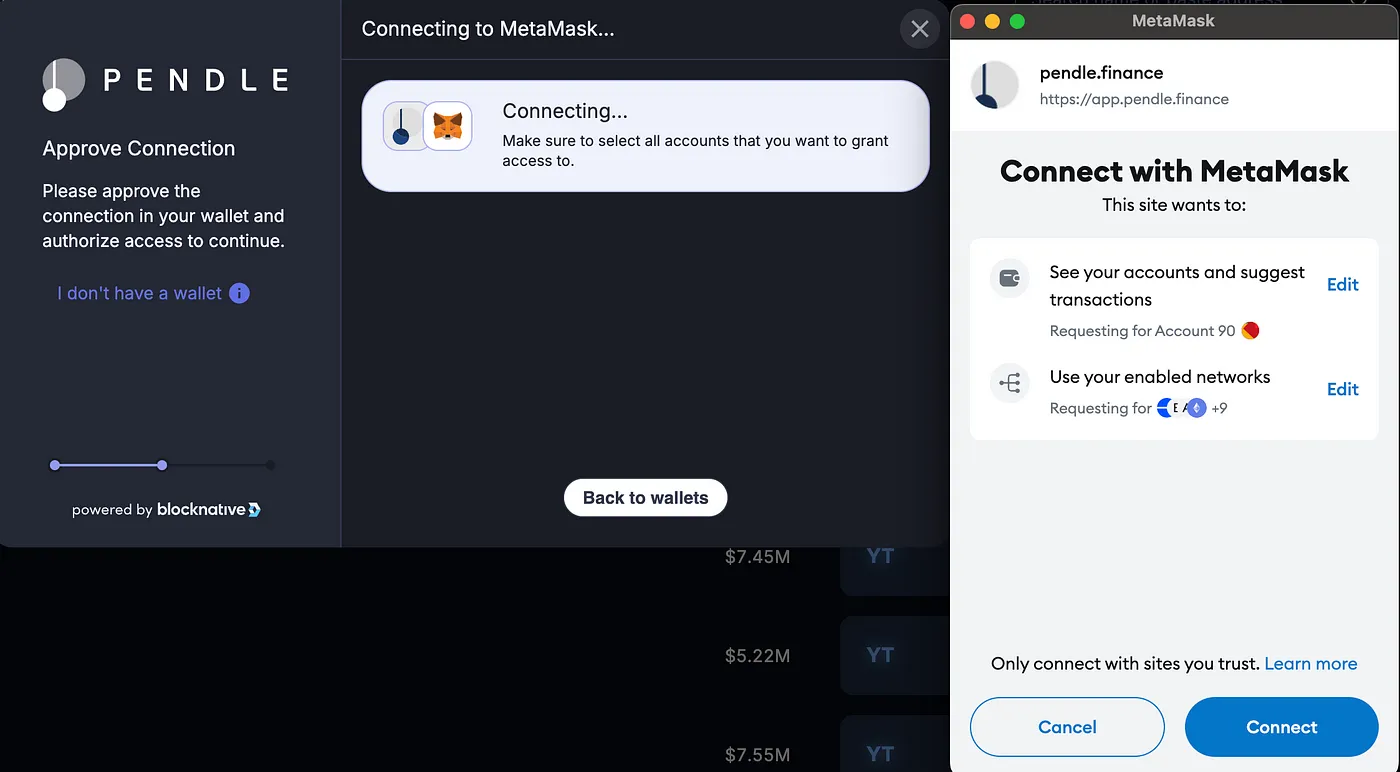

- Select MetaMask (if that's the wallet where you store your private keys).

- A popup will appear asking you to connect to the site (this step gives Pendle permission to view your public address and can suggest transaction to sign which is needed to interact with Pendle) — click Connect.

2. Choose Your Fixed Yield

At the time of writing, Ethena's stablecoin (USDe) has a variable interest rate of 9% when staked as sUSDe. However, on Pendle, you can lock in 16.75% APY with a maturity date of March 27, 2025.

- Click on the PT 16.75% button.

- You'll see historical interest rate fluctuations — rates depend on market conditions.

- Select the "PT" option on the toggle (not YT) and click Buy PT.

- Enter the amount — I set 10,000 USDe.

- The UI will show the expected return:

- By March 27, 2025, I can claim back 10,115.4 USDe.

- This translates to 16.51% APY (annualized return) or a 1.154% gain over 27 days.

- On the same screen you can inspect how the interest rate was fluctuating over a time period, as the interest rate depends on market conditions. Usually if the market is overly bullish, and a lot of people want to borrow stablecoins, the interest rate to borrow stablecoins increases and thus lenders also receive higher yields. But once you lock in an interest rate on Pendle its fixed.

3. Approve USDe Spending

Since USDe is an ERC-20 token, you must approve its usage in your wallet before Pendle can interact with it.

- Click Approve USDe.

- A MetaMask popup will appear — sign the transaction.

- This allows Pendle's smart contract to swap your USDe into PT-USDe-27Mar2025.

Why is approval needed?

The ERC-20 standard separates ownership from spending permissions, ensuring that only approved smart contracts can access your funds.

Inspect the output, it means that on 27 March, 2025 I'd be able to claim back 10115,4 USDe which is 16,51% APY (annualized return) or an actual gain of 1,154% over the course of 27 days. If this market offered a full 365 days lock period, you'd get the full 16,51%.

Note 1: The approve step is needed since USDe is an ERC20 token on the Ethereum network. ERC-20 approval signing is needed because the ERC-20 standard separates ownership from spending permissions. When you want a smart contract (like Pendle) to spend your tokens on your behalf, you must first approve it. This prevents unauthorized contracts from taking your tokens.

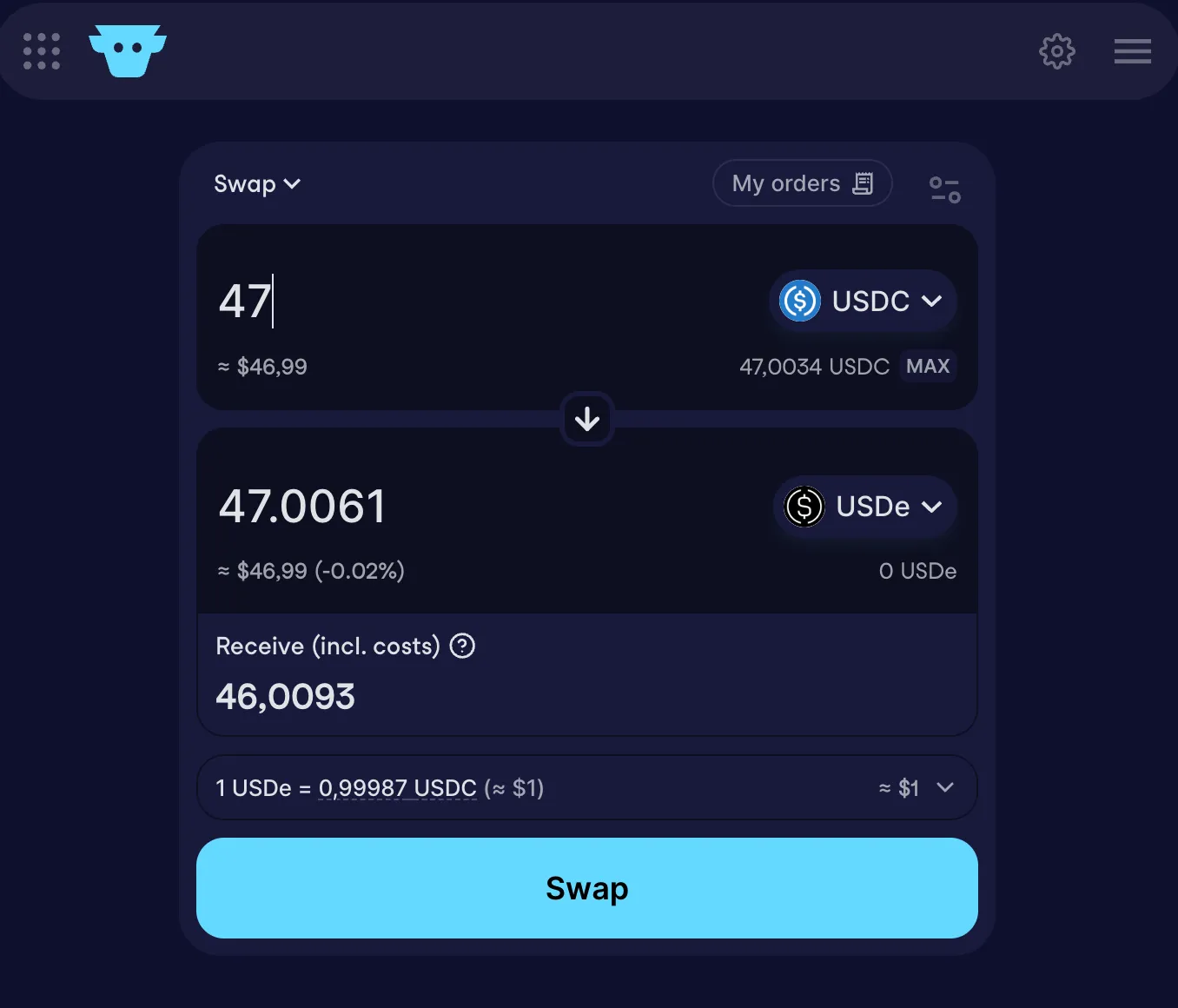

Note 2: Its best if you have USDe already on your wallet, as the fee for swapping is typically much better then swapping some other token into the USDe PT token, but in case you do not have USDe already, my recommendation is to use CowSwap as it currently gives the best swap rates across all of the DEX (distrubuted exchange) landscape:

4. Execute the Swap

- Click Swap — this will prompt MetaMask to sign the transaction.

- You are now swapping USDe into the PT token.

- Congratulations! 🎉 You have successfully locked in your fixed yield position.

In this transaction you are interacting with the Pendle smartcontract where you are swapping the USDe token into the PT-USDe-27Mar2025 token that upon the maturity date can be redeemed for the extra yield back in the USDe token.

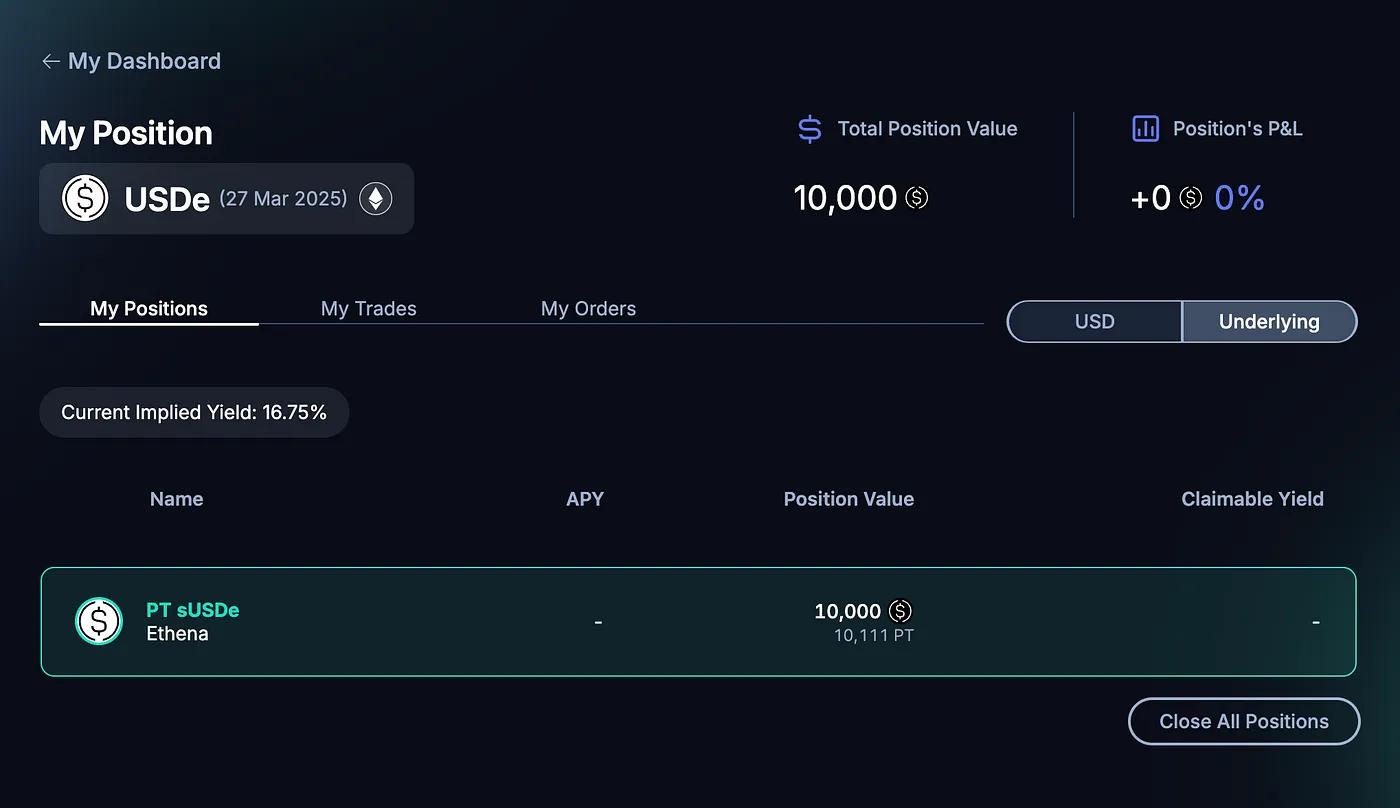

5. Monitor Your Position

- Click on "My Dashboard" to view your open positions.

- Over time, your position's P&L will increase.

- On the maturity date, you'll receive the full yield.

This screen shows your current open positions as on image above. As time passes your Position's P&L will increase and at maturity date it should get to the full 111 USDe profit.

That's it, you just made incredible returns. Now just swap back USDe for USDC or whatever crypto you prefer. I'll make another step by step post about swapping through CowSwap which gives the best exchange rates.

Making It Simpler

I shared this strategy with friends, but none felt comfortable executing it themselves.

The process involves:

- Understanding variable vs. fixed yield rates.

- Researching Pendle's mechanism.

- Navigating multiple DeFi platforms (CowSwap, Pendle, Ethena).

So, I built a product that simplifies the entire process — allowing users to lock in fixed yields with a single click.

If you're interested, subscribe to the closed alpha. 🚀